Taxes In Dropshipping Business: What Do Tax Experts Say?

Are you going to run a dropshipping business in the United States or elsewhere? In this case, we recommend you learn more about taxes. So check what you should know about ecommerce taxes to start and run a dropshipping business on favorable terms.

After you’ve registered your business, you need to learn how to deal with taxes. Today we’ll look into the whole issue of ecommerce sales tax in the USA. Whether you’re a US resident or not, the information provided in the article will be equally useful for everybody concerned.

DISCLAIMER: We’re going to answer the most frequently asked questions on dropshipping taxes. Please note that we recommend our clients start and run a dropshipping business in the USA because of the opportunities its market ensures. So we will mostly speak about dropshipping taxes in USA. If you are eager to start a dropshipping business in any other country, we recommend that you address your local authorities to clarify the dropshipping taxes details.

What should you know about dropshipping taxes? [FAQ]

Every type of business has an official part.

Dropshipping business is not an exception – as you remember, we have already discussed the strategies and benefits of registering your enterprise in the USA.

This article saw a huge interest, and numerous readers asked us about the taxation part. How could we resist?

To answer all your questions about taxes in dropshipping in a correct and professional way, we asked for the expert help.

Meet our tax expert – Sergei Suslov – Certified Public Accountant (CPA), Chartered Global Management Accountant (CGMA), and Ph.D. in Economics!

Sergei has more than 28 years’ experience in accounting, taxes, audit and finance. His SVS Accounting LLC agency focuses on business and individual income tax preparation. The agency’s major business area is assisting non-residents who run their enterprises in the United States. This accounting company is located in the state of New Jersey, nearby New York City, and it is servicing clients in all 50 states of America.

Please welcome Sergei in our blog!

Sergei Suslov – CPA, CGMA, Ph.D. in Economics

Dear fellow entrepreneurs,

Before answering your questions about taxes in dropshipping, I’d like to make two general remarks about the American tax system.

First, tax issues are taken very seriously in the United States. Everyone must pay! Even the famous Chicago gangster Al Capone was jailed back in 1931 not for racketeering and murders, but for the tax evasion.

All Americans know the phrase belonging to one of the country’s Founding Fathers – Benjamin Franklin (the guy on a $100 bill): “Nothing is certain but death and taxes”. So, do your best to follow the rules!

Second, both the American and the international tax systems are rather complicated. To make your life easier and avoid any troubles, it’s better to hire a good professional accounting firm with non-resident taxation experience to figure out your specific taxes in dropshipping.

Remember, you as a business owner have the final responsibility for taxes, so be careful! Get a piece of advice on choosing the right accountant here.

Now, let’s go to the readers’ questions!

What is the sales tax, and how to deal with it?

Let’s start with the basics. If you run your business in the USA, it doesn’t matter if it’s a grocery or an online store, you need to collect a sales tax.

A sales tax is a consumption tax imposed by the government on the sale of goods and services.

Does it sound difficult? Well, if you sell goods or services in the USA, you’re supposed to collect a sales tax and pay the very state you work in.

How much is the sales tax in the USA?

Actually, there’s no standard for the sales tax in the USA. The sales tax can vary depending on the state you work in. It ranges from 2.9 to 7.25 percent at the state level.

However, there are also exceptions to the rules. That’s why several states have a 0% sales tax, but they’re only five of them as of 2023. Here they come.

- Delaware, Montana, New Hampshire, Alaska, and Oregon.

How to collect the sales tax?

There are two options for you to collect the sales tax:

- You can include the sales tax in the product cost

Therefore, your potential customers will see a total product price without any additional notes.

- You divide the product cost and sales tax

In this case, your customers will see that they pay the sales tax each time they make a purchase.

What is the best US state to register a simple LLC for non-residents?

For a dropshipping business, you have to consider two of the most important tax parameters: state income tax and state sales tax. Some states, for example California and New York, have complicated tax reporting requirements and high tax rates. Some states do not require filing a state income tax return at all. Nevertheless, all states charge annual filing fees from the registered businesses. The same relates to a Sales tax, which we will discuss later.

From my experience, the most convenient and business-friendly states are Wyoming, Delaware and Nevada. They have no state income taxes for the businesses operating outside these states.

NB❗ According to the US law, you have to register your business in each state you sell in.

Sounds intimidating, right? But let’s not panic ahead of time. This condition applies only to businesses with an income of more than $100,000 per month in a state.

What are the tax filling requirements if you have a US company? Who handles the tax requirements of the LLC company if you live outside the US?

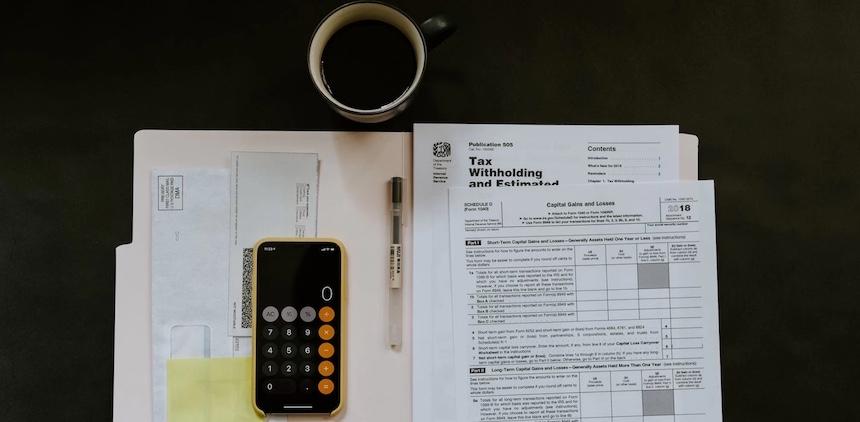

There are two main types of taxes in the Unites States: Income Tax and Sales Tax. In addition, there are several levels of taxation: Federal, State and, sometimes, City.

Income tax

Remember, a dropshipper pays taxes on income only; revenues doesn’t matter here. You already know that you can avoid paying sales tax due to the states with 0% sales taxes. Other burdens are imposed on businesses with $100,000+ income in a state.

Now let’s talk about Income tax. It is levied on net income.

It is calculated with the help of the following formula:

(Gross receipts from the business – all allowed business expenses) * Tax rate

How to calculate your income tax amount?

Let’s consider the example.

- So you sold a custom t-shirt for $100. This sum is credited to your card, and this is your revenue.

- Now let’s run the numbers. You need to deduct all the expenses from this sum: the initial price of t-shirt you paid your supplier, the cost of marketing, etc. (if there are some other expenses). Our t-shirt cost me $30. Plus, we spend $10 on Facebook ads to drive a customer to our site and make it finish the order. $100-$30-$10=$60 of profit.

- We’ve registered a business in Montana and got a client for the same state. In Montana, there’s 0% sales tax, but there’s a 1-6.75% income tax. In our case, we must pay 2,1% of income tax — $1,26.

- How to get a net profit? $60-$1,26=$58,74. Congrats!

- How to pay taxes? When you’re ready to pay taxes, you submit a declaration according to your region’s law.

It is calculated on the basis of federal tax rates for a federal income tax return, state tax rates for state tax returns, and city rates for cities. The three business-friendly states mentioned above do not have Income tax requirements on the state level.

Every business entity is subject to Income Tax reporting requirements, with a few exceptions. These reporting requirements exist even if you do not have an income or even if you have a loss. Of course, you only have federal income tax reporting requirements if you have registered your business in the non-income tax state.

Businesses must file income tax returns on time regardless of the net income amount. Punishment for LLC’s late filing is simple — $195 per member for every month of delay up to 12 months. So, for two partners it could be up to $4,680 for one year delay.

Corporation late filing penalties depend on the net income amount, and federal fines could be more moderate, but States usually hit hard following their state tax laws.

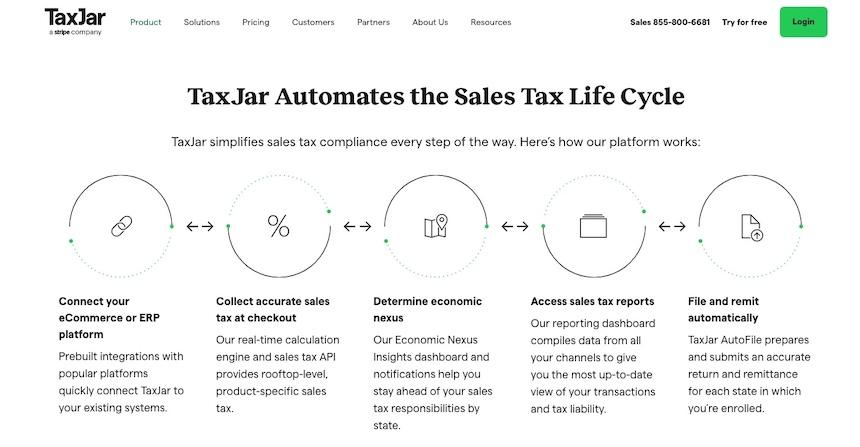

Are you afraid of making mistakes in tax calculations? Use the taxjar.com service to automate your tax payments.

Sales tax

This is is an extra charge on the goods sold in retail sales. Sales Taxes are levied by States (not a federal government) from the businesses located within their jurisdictions. They are applied to the retail sales made to the same state residents.

For example, if you registered your business in the state of Delaware and sold goods to New York residents without presence in New York, you owe zero Sales Tax to either state. So, if you sell a $100 item you charge your client for $100 and this amount is your Gross Revenue.

If you registered your business in the state of New York and sold goods in the same state, you have to pay Sales Tax to the state (and possibly to the city) of New York. In this case, if you sell a $100 item you charge your client for $100 + 8.75 NY Sales tax. A $100 is your Gross Revenue and $8.75 is a Sales Tax amount, which you must pay to the state of New York.

From a tax planning point of view, the conclusion is simple: do not register your dropshipping business in the state where you are going to have the majority of your online sales.

Your accountant will calculate the sales tax amount, make necessary sets up with the state and arrange automatic tax withdrawals from your bank account. All you need to do is keep enough money in the bank.

When you have established an American company, your personal place of living is not related to the reporting requirements. For most businesses, you hire an accounting firm which monitors these requirements and lets you know when it is time to report and pay taxes.

Nowadays international communication is not a problem. You can easily arrange all your business affairs with your accounting company through the internet, telephone and mailing service. Again, the key issue is to find a good accountant, everything else will be easy.

Before doing your taxes in dropshipping, an accountant will need to do your books. We call this process bookkeeping, or write up. During the bookkeeping process, an accountant records all your financial transactions into the books and allocates them between accounts in accordance with rules and regulations. If you had a business in your country, you must be familiar with this procedure. Of course, the rules of bookkeeping are different from country to country.

What is Income Tax Return?

Okay, there’s an Income Tax. But what is an Income Tax Return?

Tax Return is an American name for an income tax declaration – a document existing in most countries around the world. Your accountant prepares this document for you every year. It reflects all your business gross receipts, all allowed by tax law expenses, and calculates taxes on the net income (gross receipts less expenses).

In most cases, it is mandatory to prepare and file the annual income tax returns to tax authorities.

Nevertheless, there are some situations when you can avoid filing. For example, if you registered a single member LLC and did not have any activity during the year, you can skip filing for this year.

If you have a loss, the tax filing could be favorable for you, because the loss will be forwarded for 20 years ahead and your future taxable income will be decreased. The similar circumstances for a multi-member LLC could be more complicated.

It is better to discuss this issue with your accountant. A Corporation must always file the tax return, no matter what.

When do we need to file income tax returns?

LLC’s and Corporations income tax returns are paid once a year, usually on or before March 15 of the next year. Nevertheless, the government wants you to pay ¼ (25%) of your future annual taxes every three months (quarterly).

Because nobody is capable to predict the future, accountants use estimates. It is advisable, but not obligatory to make these quarterly advance payments (estimates). If you ignore them, Internal Revenue Service simply accrues interest on underpaid taxes at 2-3% annual rate, and you will pay it along with your regular taxes after yearend.

For example, your annual taxes in dropshipping were $10,000. You had to pay $2,500 in April, June, September and December, but you did not. IRS will accrue additional amount as follows:

$2,500 x 3%/12 x 8 + 2,500 x 3%/12 x 6 + 2,500 x 3%/12 x 3 = $106.25

What are other tax limitations there in the US?

There’re, actually, some other aspects you should take into account when considering business taxation.

Economic nexus

What is the economic nexus?

Economic nexus implies that you have to collect sales tax in a state in case you earn above a sales or revenue threshold in that specific state.

It may seem too complicated, but there’s absolutely nothing challenging about it.

So if you’ve registered your business in, let’s say, Nevada, but you sell goods throughout the US, you need to carefully monitor your activities in each state.

First of all, you need to make sure that you haven’t reached a $100,000/month point in a state yet. If you have, congratulations! It means you’ve grown a really successful business. However, you’ll have to register your business in that very state. But it’s not a big deal.

Moreover, it’s necessary to check how many transactions you’ve in each state. If you don’t want to be subjected to economic nexus, there must be no more than 200 transactions a month in a state.

Physical presence nexus

All the states have a slightly different definition of nexus.

If we’re speaking about a physical presence nexus, it refers to your physical presence in a state (a warehouse, a headquarter, a brick-and-mortar store, etc.).

So if you have a warehouse that is full of products you sell, you will have to pay a tax for this in the state your warehouse is located.

Fortunately, if you’re going to start an online store, it doesn’t imply your physical presence in any state. This is why, with an ecommerce business, there’s no need to worry about the physical presence nexus.

Are there ways to automate the sales tax life cycle?

It becomes clear that if you run an ecommerce business in the USA, all you need to do to properly deal with the sales tax is to monitor a couple of aspects. However, in case you’re going to do this manually, it will take you time and effort that you’d better devote to the task requiring your particular participation.

So are there any ways to automate the sales tax life cycle? In fact, there are some. One of them is TaxJar.

TaxJar was started to let you take care of a critical part of managing your business with no effort. TaxJar does the heavy lifting for you by automating your most tedious tasks. It accurately calculates sales tax rates, classifying products, and managing multi-state filing.

Due to the TaxJar dashboard, you will be able to see the states you have customers from, revenues, and the number of transactions in each state in real-time. Beyond the economic nexus, with TaxJar you can easily collect accurate sales taxes at checkout, access sales tax reports, file, and remit automatically, and so on.

How much should we pay for accounting services?

Every business will need a bookkeeping service and federal income tax return preparation. Depending on the state and city registration, you may have additional state and city income tax filing requirements.

If your business is subject to the Sales Tax, you will need to file Sales Tax returns. To do all this reporting, you hire an American accounting firm. Every accounting firm sets up their own pricing system. They could charge you separately for every service or set up the flat fees for all reporting together. For example, our firm charges separately:

- Bookkeeping – starting from $25/month;

- Sales Tax returns – $100 per three months (a quarter) on average;

- Income Tax Returns – mostly $750 (once a year, including federal and one state).

These prices are not written in stone and could fluctuate. We believe to have the best prices on the market in terms of the quality/cost ratio.Of course, nobody wants to pay too much, but low prices could lead to the trap of an incompetent “specialist”.

You can save hundreds on accounting fees, but lose thousands on extra taxes and penalties. Nothing could be more expensive than a cheap accountant.

If you still have questions, get more details regarding taxation of non-residents doing business in the United States of America here.

We are really thankful to Sergei for this professional advice on taxes in dropshipping! Hopefully, the subject is much clearer to our readers now, and nothing stops them from starting their own businesses from home!